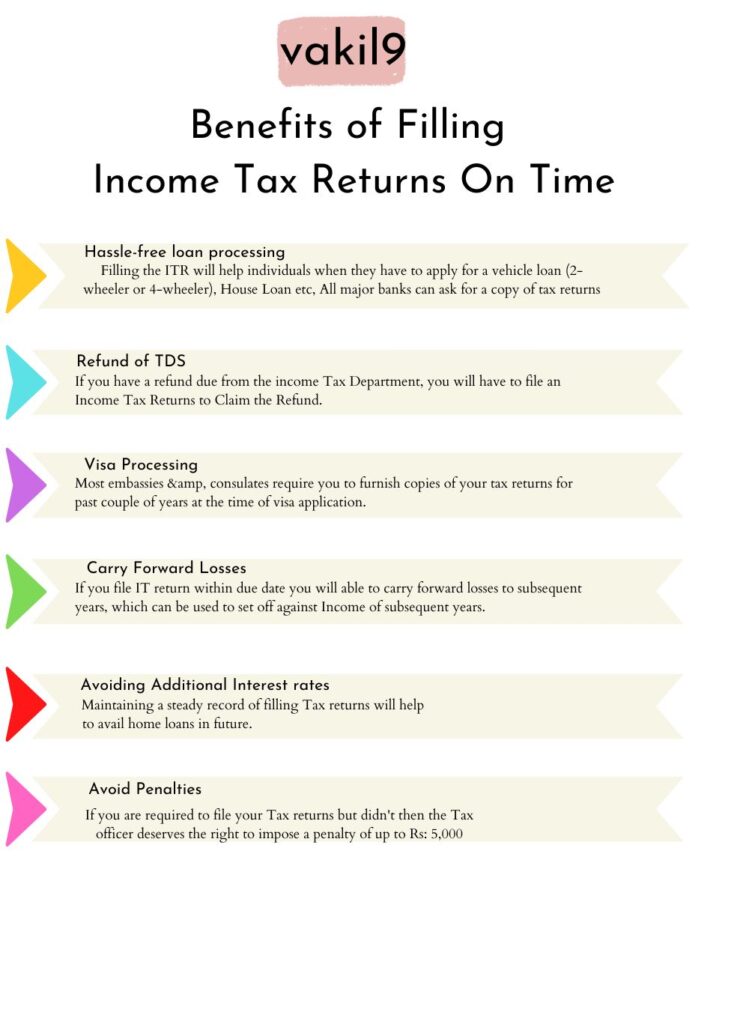

Filing Income Tax Returns Online

Each responsible Indian citizen must file their taxes on income to the government. Modern technology makes it easy to submit your tax returns online. This is quick and precise, with no deadlines.

The process of e-filing taxes on income in India on the official website is a matter of filing ITR forms. There’s an ITR type for people who are not individuals and an ITR Form for salaried people. This is an essential task as the income tax department has various forms, starting with ITR 1 to ITR 7. Each form is designed to serve a particular purpose and falls into specific categories.

Even if you do not fill in one field on the form or make mistakes, your tax return isn’t completed on time. This is the reason you require an expert’s assistance. Vakil9 is a tax filing company that frequently files income tax returns for institutions and individuals. Therefore, you can count on Vakil9 to file your tax returns. To do this, you’ll be required to supply us with the below documents.

[formidable id=1]

Steps to File Income Tax Returns (ITR)

The first step is to ensure that you have all your soft copies, scans of all your necessary documents, such as your bank statements and your tax return for the previous year. It is also recommended to complete the income tax form 16.

- Submit all required documents to our experts

- Through the portal that is registered, our experts will file your tax returns on the internet.

- ITR Filling form will be chosen according to your specific category and the experts will fill in the required fields and file any exemptions that are applicable.

- Our specialists will advise you about the tax due amount, if there is any, following all exemptions

- Subsequently the tax return for your earnings are filed with no difficulty.

Documents Required for ITR return File